Call FREE: 0800 046 9840

Email us: enquiries@merritts.uk.com

It is rare that there is anything in a Budget Statement specifically relevant to machinery moving, but the announcement of freeports has gained our attention because we think the tax advantages and investment incentives will give UK manufacturing a huge boost.

We welcome the idea of establishing freeports again as we think that the economic activity will create jobs, encourage regeneration and provide a welcome boost for product manufacturers, machinery manufacturers, agents and distributors, machinery transport & installation companies like Merritts and other companies in related supply chains too.

Why do we think this?

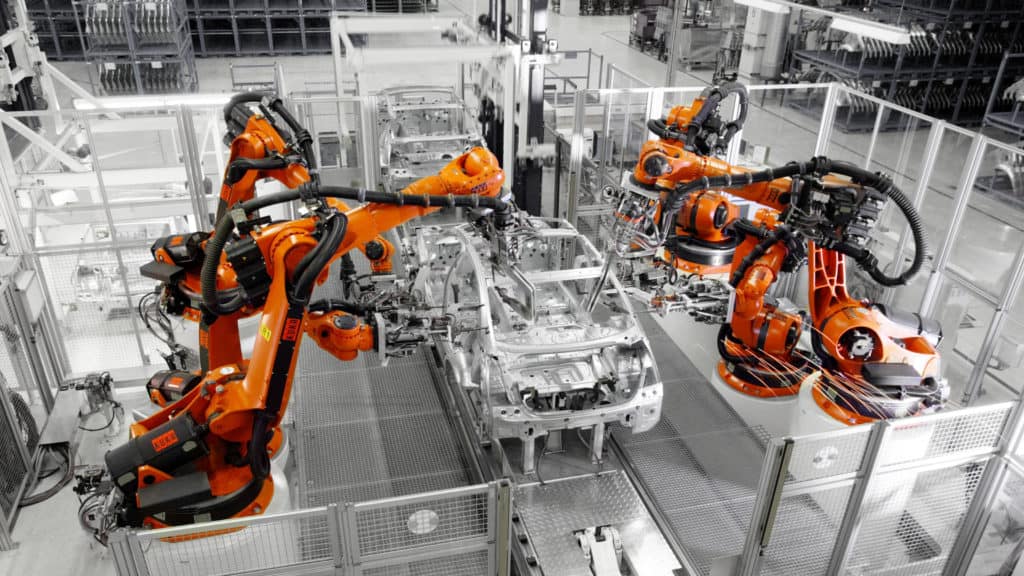

First and foremost, new factories are likely to be built in the freeport enterprise zones. This will mean a requirement for new machinery and also machinery relocation projects. This is good news for machinery manufacturers worldwide, plus, when companies are upgrading machinery it usually means an increase in the availability of high quality second hand machinery which will enable smaller manufacturers to buy more efficient machines to scale production and improve productivity.

Tax breaks and incentives

To give added incentives to fuel economic growth in freeport areas, the Government has also announced a range of tax reliefs that are expected to last for a period of five years. These include:

- An enhanced 10% rate of structures and buildings allowance for constructing or renovating non-residential structures and buildings within freeport tax sites in Great Britain.

- An enhanced capital allowance of 100% for company investment in plant and machinery for use in freeport tax sites in Great Britain.

- Full relief from stamp duty land tax (SDLT) on the purchase of land or property within freeport tax sites in England where it is purchased and used for a qualifying commercial purpose.

- Full business rates relief available to all new business and certain existing businesses that have expanded.

- Tax relief on employer national insurance contributions (NIC) relief for eligible employees in all freeport tax sites

With such a package of incentives on offer and in a period where businesses can still access funding at low rates due to extensions to the business recovery loan scheme there is probably no better time to invest in buildings and assets such as plant and machinery.

What are freeports?

Freeports are similar to enterprise zones and are designated geographical areas, recognised in law, where businesses can benefit from more generous tax reliefs, customs benefits, simpler planning, and wider government support.

The freeports concept is not new. Between 1984 to 2012, there were seven in the UK at various locations around shipping ports and airports, but legislation allowing them has lapsed.

Where are the UK’s freeports going to be?

The areas announced are East Midlands Airport, Felixstowe and Harwich, the Humber region, the Liverpool City Region, Plymouth, Solent, Thames, and Teesside.

How can Merritts help?

There are three main areas where we can help:

Machinery transport & Installation

We are able to provide heavy lifting and transport services to collect machinery from site or port of arrival and safely deliver to its new location. We can then offload the machinery, transport into the facility and carry out installation and commissioning services.

Industrial storage and bonded warehousing

Our industrial storage facility is also an ideal location within which to store assets that need to remain on the balance sheet or carry out heavy machinery maintenance and refurbishment works.

This facility is also an HMRC approved bonded warehouse storage and might be of benefit to UK machinery agents and distributors who may import machines that have not yet been sold. They are also used by manufacturers who have purchased machinery in advance of the completion of the site where it will be installed. By using our bonded warehousing storage, our customers are able to buy machinery when the best deals or finance is available, whilst also deferring payment of import duty and VAT.

Export packing and shipping

If you are machinery dealer and selling industrial equipment or second hand machines to an overseas buyer our export packaging and shipping service ensures your heavy equipment is fully protected from damage during transit and international shipping. Our machinery moving services extends to covering all necessary paperwork for both UK and European deliveries.

Merritts are SafeContractor accredited, and as part of our comprehensive process, can provide advice on all your machinery moving requirements, as well as offer free site visits within the UK. We have an extensive range of modern vehicles and lifting equipment; most of which have been custom built to our own specification to fulfil the requirements of the machine transport & installation industry.

If you are considering a heavy machinery removal, relocation, or installation project, need to temporarily store new or redundant heavy machinery, or simply need space to carry out servicing and maintenance, please get in touch or complete the enquiry form.